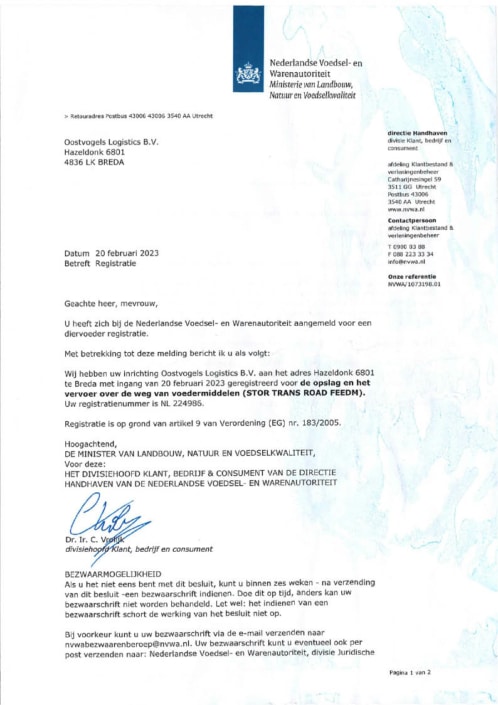

As your general fiscal representative with an Article 23 license, we facilitate VAT deferment at import for non-Dutch companies. We represent your company in the Netherlands, managing all transactions and VAT submissions. Your physical presence in the Netherlands is not required.

The Benefits of a Fiscal Representative in the Netherlands The Netherlands is known as a key transit country for goods from outside the EU, offering tax-attractive schemes for international companies.

With Oostvogels as your fiscal representative, you enjoy several benefits:

- No need to register your company in the Netherlands;

- No requirement to set up and maintain a separate VAT administration;

- VAT on import does not need to be paid upfront; it is deferred to the VAT return of the representative, benefiting your cash flow.

International trade, especially outside the EU, can be complex. Oostvogels ensures that the correct agreements and schemes are applied to your situation. We specialize in offering the most advantageous solutions for your business.

Learn more on the website of Neele-Vat